Do not send the completed forms to IRAS. For more details, you may refer to www. The amount of retirement benefits accrued up to 31 Dec if the employee received the retirement benefit from an existing approved pension and provident fund upon reaching the statutory retirement age. The payment should not include taxable components such as gratuity, notice pay, ex-gratia payment, etc. Appendix 01 - Form of

| Uploader: | Gogrel |

| Date Added: | 25 January 2011 |

| File Size: | 44.22 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 85103 |

| Price: | Free* [*Free Regsitration Required] |

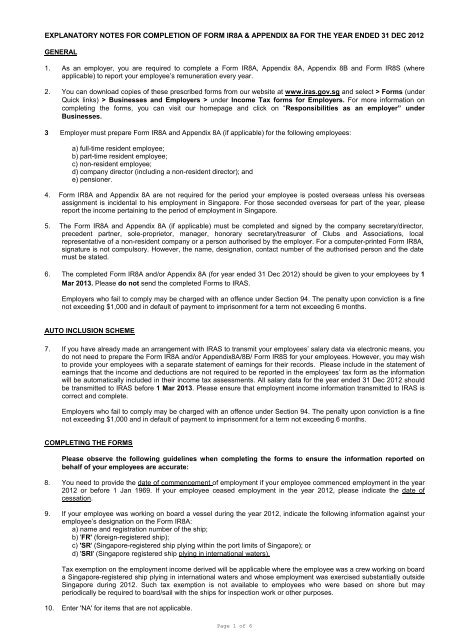

Employer needs to state the: Complete this item if the contributions: However, you may wish to provide your employees with a separate statement fotm earnings for their record. Report donations, contributions to Mosque Building Fund, life insurance premiums for the whole year Period of overseas Posting I whole year?

The gains or profits include all benefits, whether in money or otherwise, paid or granted to him in respect of employment. Refer to the table below for the procedures when reporting income of employees who are: Only report the employment income for the Singapore employment in items a to d. For examples of when bonuses are to be declared, refer to www.

IR8A for SG - SAP Q&A

A photoactivatable GFP for selective photolabeling of proteins and cells. Accommodation and related benefits provided by employer assuming the employee worked from 1 Jan to 31 Dec Place of Residence Period when the premises was provided: Ionotropic forj receptors IR64a and IR8a form a functional odorant receptor complex in vivo in Drosophila.

If your employee was a crew working on board a Singapore-registered ship plying in international waters and the employment was exercised substantially outside Singapore duringthe employment income is exempted from tax.

Bribery Act - Exp Below are some useful information to assist you in completing the Appendix 8A: For more details, refer to www.

Ir8a forms download

However, if the serviced apartment is located within a hotel building, report the ir8x cost incurred by the employer, less amount paid by the employee under Section 3. For more information on the taxability of the various gains or profits arising from employment, refer to www. If the car ir8aa not provided to the employee for the full year, the cost of the car can be apportioned based on the number of days that the car was provided to employee in the year.

Q-plate before 1 Aprthe cost of the car should be pegged to that of an identical private car. How to Write Explanato However, the name, designation, contact number of the authorised person and the date must be stated. Full cost of any leave passages provided to other family members. If the car was company if8a i. LarssonAna I.

IR8A for SG

Complementary function and integrated wiring of the evolutionarily distinct Drosophila olfactory subsystems. Explanatory notes to C Include remuneration paid by overseas employers to employees performing personal services in Singapore and maternity leave payments for working mothers; and Exclude NSmen Pay paid directly to employees by Mindef, Singapore Civil Defence Force or Singapore Police Force.

The details of the taxable benefits-inkind are to be reported in Appendix 8A and the total value of benefits-in-kind must be entered in item d9 of Form IR8A. Gains or profits derived by the employee, directly or indirectly by reason of any office or employment from the: For a computer-printed Form IR8A, signature is not compulsory.

Appendix 01 - Form of Explanatory notes to S Compensation for loss of office is not taxable. You can download these prescribed forms from www.

Suh Published in The Journal of neuroscience: Leave passage provided to Value of benefit?

Комментариев нет:

Отправить комментарий